Same day title loans Texas offer quick cash access using vehicle equity as collateral, ideal for urgent financial needs and less-than-perfect credit borrowers. Eligibility requires owning a vehicle free and clear, proof of income, and a valid driver's license. Funding is swift, with deposited funds typically into the borrower's bank account; repayments are regular installments over a fixed period, avoiding penalties and offering lower interest rates due to vehicle security.

Looking for quick cash in Texas? Same-day title loans could be a viable option, offering fast access to funds without the usual credit checks. This article guides you through the process of understanding and accessing these short-term loans. We’ll explore the eligibility criteria, ensuring you know what’s required, and provide step-by-step insights on how to apply and repay quickly. Get ready to navigate Texas’ unique lending landscape with confidence.

- Understanding Same Day Title Loans Texas

- Eligibility Criteria for No Credit Check Loans

- How to Access and Repay Your Loan Quickly

Understanding Same Day Title Loans Texas

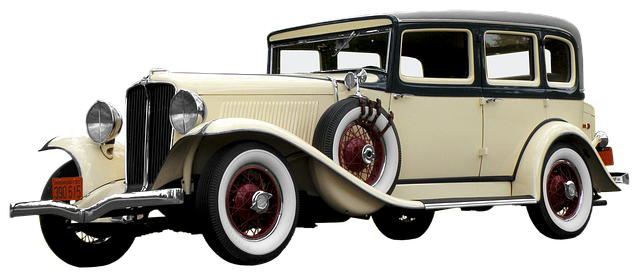

Same day title loans Texas have gained popularity as a quick solution for borrowers seeking emergency funding. This unique type of loan allows individuals to use their vehicle’s equity as collateral, providing access to cash in a matter of hours. The process is designed to be efficient and straightforward, catering to those with less-than-perfect credit or an urgent need for money. Unlike traditional loans that may require extensive documentation and rigorous credit checks, same day title loans offer a more lenient approach.

The Title Transfer plays a crucial role in this transaction, as it serves as security for the loan. Lenders will assess your vehicle’s value through a comprehensive Vehicle Valuation to determine the maximum loan amount eligible. Once approved, borrowers can receive their funds promptly, making same day title loans Texas an attractive option for those in need of quick liquidity without compromising their asset.

Eligibility Criteria for No Credit Check Loans

When considering same day title loans Texas with no credit check, it’s important to understand that eligibility criteria play a key role. Lenders typically require borrowers to meet certain conditions to qualify for this type of loan. These often include owning a vehicle free and clear, providing proof of income, and having a valid driver’s license. The vehicle serves as collateral for the loan, ensuring the lender has security in case of default.

Quick Funding is a significant advantage of same day title loans Texas with no credit check. Once approved, funds are often deposited directly into the borrower’s bank account via direct deposit, providing immediate access to the borrowed amount. This makes such loans an attractive option for individuals in need of fast cash for unexpected expenses or emergencies.

How to Access and Repay Your Loan Quickly

Accessing same day title loans Texas is a straightforward process, designed to get you the funds you need quickly and easily. The first step is to determine your loan requirements. Lenders will evaluate your vehicle’s value, typically using its make, model, year, and condition as primary factors. If you own a motorcycle, it can also serve as collateral for a motorcycle title loan. This ensures that the lender has security in case of default.

Repayment is just as simple and usually involves making regular payments over a set period. Since these loans are secured against your vehicle, the interest rates tend to be lower than other short-term loan options. Maintaining timely repayments can help you avoid any penalties or additional fees. Using your vehicle collateral effectively allows you to access urgent funds without the usual stringent credit checks, making same day title loans Texas a viable option for many individuals in need of quick cash.

Same day title loans Texas offer a unique solution for individuals in need of quick cash, even with less-than-perfect credit. By leveraging the equity in your vehicle, these loans provide a straightforward and efficient way to access funds without extensive waiting periods or strict credit checks. With a clear understanding of eligibility criteria and a simple application process, you can navigate this option swiftly and potentially turn your vehicle’s value into much-needed relief. Remember, responsible borrowing is key; ensure you fully comprehend the repayment terms before securing a same day title loan Texas to maintain financial stability.