Same day title loans Texas provide swift financial aid based on a vehicle's value, disbursing funds within hours for urgent needs, even with less-than-perfect credit. Efficient and flexible, they omit extensive paperwork and strict credit checks, but come with higher interest rates and potential repossession for missed payments. Compared to traditional lending methods, these loans offer quicker access but may have steeper rates; the best choice depends on personal circumstances, financial health, and urgency.

In today’s fast-paced world, access to immediate funds is crucial. Same day title loans Texas offer a unique solution, providing quick cash solutions secured by your vehicle’s title. This option distinguishes itself from traditional lending methods like banks or credit unions. While conventional borrowing routes typically involve extensive paperwork and longer processing times, same day title loans present an attractive alternative for those needing swift financial aid. This article explores these two options in detail, helping you make informed decisions.

- Understanding Same Day Title Loans Texas: A Quick Cash Solution

- Traditional Lending Options: The Conventional Approach to Borrowing

- Comparing the Pros and Cons: Making an Informed Decision Between Same Day Title Loans Texas and Traditional Lending

Understanding Same Day Title Loans Texas: A Quick Cash Solution

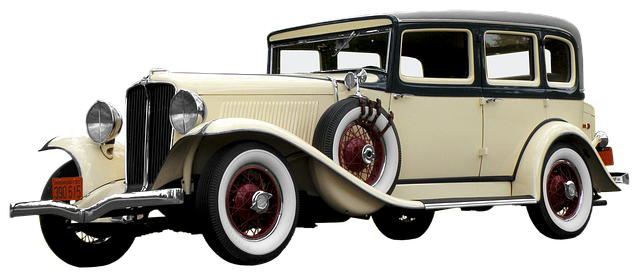

Same day title loans Texas offer a quick cash solution for individuals seeking immediate financial aid. These loans are secured by the owner’s vehicle, allowing lenders to provide funding based on the car’s value rather than the borrower’s credit history. The process is designed to be efficient, with applicants able to receive funds within hours of applying and approval. This makes same day title loans a viable option for those in need of fast money, even if they have less-than-perfect credit or no credit at all.

Unlike traditional lending options that often require extensive paperwork and strict credit checks, same day title loans Texas provide a more flexible approach to borrowing. Lenders focus on the vehicle’s equity rather than the borrower’s financial history, making it easier for individuals with bad credit to gain access to emergency funds. Furthermore, these loans typically offer flexible payments, allowing borrowers to manage their repayments based on their financial capabilities and timelines. This unique aspect makes Fort Worth loans a popular choice for those seeking a hassle-free and adaptable financing solution.

Traditional Lending Options: The Conventional Approach to Borrowing

Traditional Lending Options represent the conventional approach to borrowing money, often involving banks or credit unions. These methods typically require a detailed application process, where borrowers provide financial and personal information. The lending institution assesses the borrower’s creditworthiness based on factors like credit history, income, and existing debt. Once approved, loans are usually offered at interest rates determined by market conditions and the borrower’s risk profile. This process can be time-consuming, often taking several days or even weeks to finalize, especially for larger loan amounts.

In contrast to Same Day Title Loans Texas, traditional lending options may not be as accessible for those with less-than-perfect credit. The emphasis on extensive documentation and strict eligibility criteria ensures a thorough assessment of the borrower’s financial health but might exclude individuals in urgent need of funds due to the lengthy approval timeline and stringent requirements, such as vehicle valuation and title transfer processes.

Comparing the Pros and Cons: Making an Informed Decision Between Same Day Title Loans Texas and Traditional Lending

When considering your financial options, understanding the differences between same day title loans Texas and traditional lending methods is crucial. Same-day title loans offer a unique advantage by providing quick access to cash using your vehicle’s title as collateral, with approval possible within hours. This option appeals to those in need of immediate funds for emergencies or unexpected expenses. However, it comes with higher interest rates compared to conventional loans, and if you miss payments, severe consequences may follow, including repossession.

In contrast, traditional lending options, such as bank loans or credit lines, often have longer approval times but generally offer lower interest rates and more flexible repayment terms. These methods might be better suited for those with established credit histories and stable financial situations. Fort Worth loans, motorcycle title loans, and other secured lending alternatives provide a middle ground, offering faster processing than banks while potentially avoiding some of the steepest interest rates associated with same-day title loans Texas. Ultimately, the choice depends on individual circumstances, financial health, and the urgency of one’s needs.

When considering same day title loans Texas versus traditional lending options, it’s clear that each has its advantages. Same day title loans offer speed and accessibility, making them ideal for urgent needs, while traditional lending provides a more comprehensive range of repayment terms and credit building opportunities. Ultimately, the best choice depends on individual financial circumstances and priorities. By understanding the pros and cons of each option, borrowers in Texas can make an informed decision that aligns with their unique situation.