Self-employed Texans can access quick cash through same day title loans, using their vehicle titles as collateral. With fast approval and flexible terms, these loans offer an alternative to traditional financing but require careful consideration of high interest rates. Compare offers from San Antonio or Houston lenders to find the best terms for your situation.

“Same-day title loans Texas offer a lifeline for self-employed workers in need of quick cash. This option, unique in its immediacy, leverages the equity in your vehicle title. In this guide, we demystify the process, focusing on ‘same-day’ Texas title loans specifically tailored for self-employed individuals. We’ll explore eligibility criteria, step-by-step application processes, and the benefits of this secure lending option. By understanding how these loans work, you can make informed decisions when financial challenges arise.”

- Understanding Same Day Title Loans Texas

- Eligibility Requirements for Self-Employed

- How to Secure Quick Cash Using Your Vehicle Title

Understanding Same Day Title Loans Texas

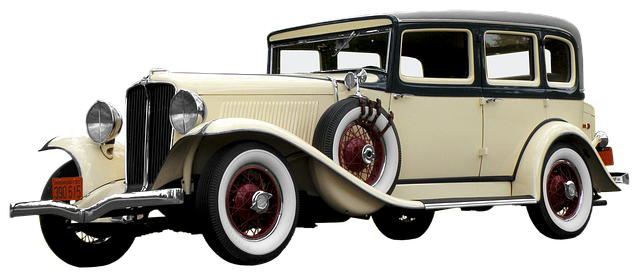

Same day title loans Texas offer a unique financial solution for self-employed individuals who may need quick access to cash. This type of loan is designed to provide immediate funding by leveraging the equity in an asset, often a vehicle or property owned by the borrower. The process involves using the title as collateral, allowing lenders to provide funds on the same day, catering to urgent financial needs.

These loans are particularly beneficial for self-employed workers who may not have steady employment records or traditional credit histories, making them ineligible for conventional loans. With a direct deposit of the loan amount into their accounts, borrowers can access the funds promptly. Unlike bad credit loans, same day title loans offer a chance for individuals with less-than-perfect credit to secure financing without extensive paperwork or lengthy approval processes. Additionally, if needed, loan extensions may be available, providing flexibility for borrowers.

Eligibility Requirements for Self-Employed

In Texas, self-employed individuals looking for urgent financial assistance can explore same-day title loans as a viable option. To be eligible for this type of loan, prospective borrowers must meet certain criteria. Firstly, they need to have a clear and marketable vehicle title in their name, which serves as collateral for the loan. This ensures that the lender has security in case of default. Additionally, self-employed workers should provide proof of income, demonstrating their ability to repay the loan on time. Lenders often require tax returns or business financial statements to assess loan eligibility.

While same-day title loans Texas offer a swift solution for immediate cash needs, it’s crucial to understand that interest rates can be higher compared to traditional loans. Self-employed individuals should also consider other alternatives like personal loans or semi-truck loans if they have collateral, as these might come with more competitive terms. A title pawn is another option, but it involves pawning your vehicle title until the loan is repaid, which could impact your daily commute.

How to Secure Quick Cash Using Your Vehicle Title

Securing quick cash as a self-employed worker can be a challenge, but same day title loans Texas offer a solution. One way to access this type of loan is by using your vehicle’s title. The process is simple and straightforward. You essentially use your car or truck’s registration and title as collateral to borrow money. This ensures lenders have security, enabling them to provide you with a loan on the same day.

Once approved, you’ll receive funds quickly, typically within hours. The repayment options for same day title loans Texas are flexible, allowing self-employed individuals to manage their finances effectively. Compare San Antonio loans or explore Houston title loans to find the best terms for your situation. This alternative financing method can be a game-changer when immediate financial support is needed.

Same day title loans Texas can be a valuable option for self-employed individuals in need of quick cash. By leveraging their vehicle titles, they can access much-needed funds within hours. This alternative financing solution is particularly beneficial during unforeseen financial emergencies or to cover unexpected business expenses. However, it’s crucial to understand the eligibility criteria and choose reputable lenders to ensure a smooth borrowing experience.