Same day title loans Texas offer a swift financial solution for Texans needing immediate cash, leveraging vehicle collateral for approval and funding within one business day. These short-term loans require minimal paperwork, focus on vehicle value assessment, and provide quick turnaround times with flexible repayment options. While convenient, borrowers should evaluate terms, rates, and fees to make informed decisions aligning with their financial capabilities.

“Uncover the ins and outs of same-day title loans in Texas, a convenient and potentially fast financial solution. This comprehensive guide breaks down what these loans entail and how they operate within the state’s regulatory framework. From understanding the concept to exploring its advantages and drawbacks, we simplify the process. Whether you’re considering this option for immediate funding or simply curious, this article offers valuable insights into same-day title loans Texas, empowering informed decisions.”

- What Are Same Day Title Loans?

- How Do Same Day Title Loans Work in Texas?

- Benefits and Considerations of Same Day Title Loans in Texas

What Are Same Day Title Loans?

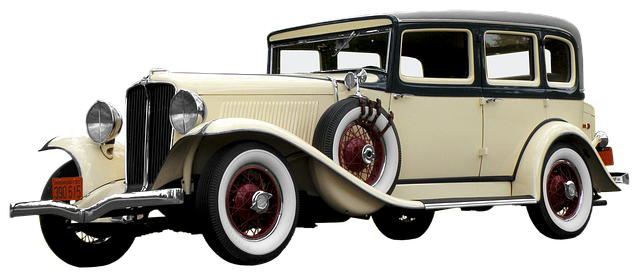

Same day title loans Texas are a type of short-term financing where individuals can borrow money using their vehicle as collateral. This quick loan process allows borrowers to access cash in as little as one business day, making it an attractive option for those needing immediate financial assistance. The key feature is the speed at which these loans are disburhed, hence the ‘same day’ label.

Unlike traditional loans that may require extensive paperwork and a thorough credit check, same day title loans Texas operate with simpler loan requirements. The primary requirement is ownership of a vehicle, which serves as collateral for the loan. The lender will assess the vehicle’s value through a quick vehicle valuation process to determine the maximum loan amount available to the borrower. This efficient approach ensures that individuals can get the funds they need without prolonged waiting times.

How Do Same Day Title Loans Work in Texas?

Same day title loans Texas operate on a straightforward principle. It involves using your vehicle’s title as collateral to secure a loan. Here’s how it works:

1. You apply online or in-person at a lender, providing details about your vehicle, including its make, model, and year.

2. The lender conducts a quick assessment, often using advanced technology for a vehicle valuation to determine the car’s current market value.

3. If approved, the loan amount is dispersed directly into your bank account on the same day—hence the name “same day.” You retain possession of your vehicle during this process.

4. Repayment typically involves making regular monthly payments over a set period, and once the final payment is made, the lender’s lien on your title is released. Be mindful that failing to repay can result in repossession of your vehicle. This quick turnaround makes same day title loans Texas a popular choice for individuals needing emergency funds fast without traditional banking options. Additionally, compared to other short-term loan types, these loans often have fewer stringent requirements and quicker processing times.

Benefits and Considerations of Same Day Title Loans in Texas

Same day title loans Texas offer a unique financial solution for individuals in need of quick cash. One of the key benefits is their accessibility; these loans are designed to provide fast funding, often within hours of applying. This is particularly useful during unexpected financial emergencies or when you require money urgently. The process is generally straightforward, with an online application that allows Texas residents to submit their requests conveniently from home.

Considerations for same day title loans include understanding the repayment options available. Lenders typically offer flexible terms and various repayment schedules, ensuring borrowers can manage their debt effectively. Quick approval is a significant advantage, but it’s crucial to assess the loan terms, interest rates, and any associated fees to make an informed decision. Repayment plans should align with your financial capacity to avoid potential pitfalls.

Same day title loans Texas offer a convenient and quick solution for individuals needing immediate financial support. By leveraging the equity of their vehicle, borrowers can access cash within hours, providing relief during unexpected financial emergencies. However, it’s crucial to weigh the benefits against potential risks, such as high-interest rates and the possibility of default, ensuring an informed decision that aligns with your financial needs and capabilities.